To me, Temu

- Jun 19, 2024

- 1 min read

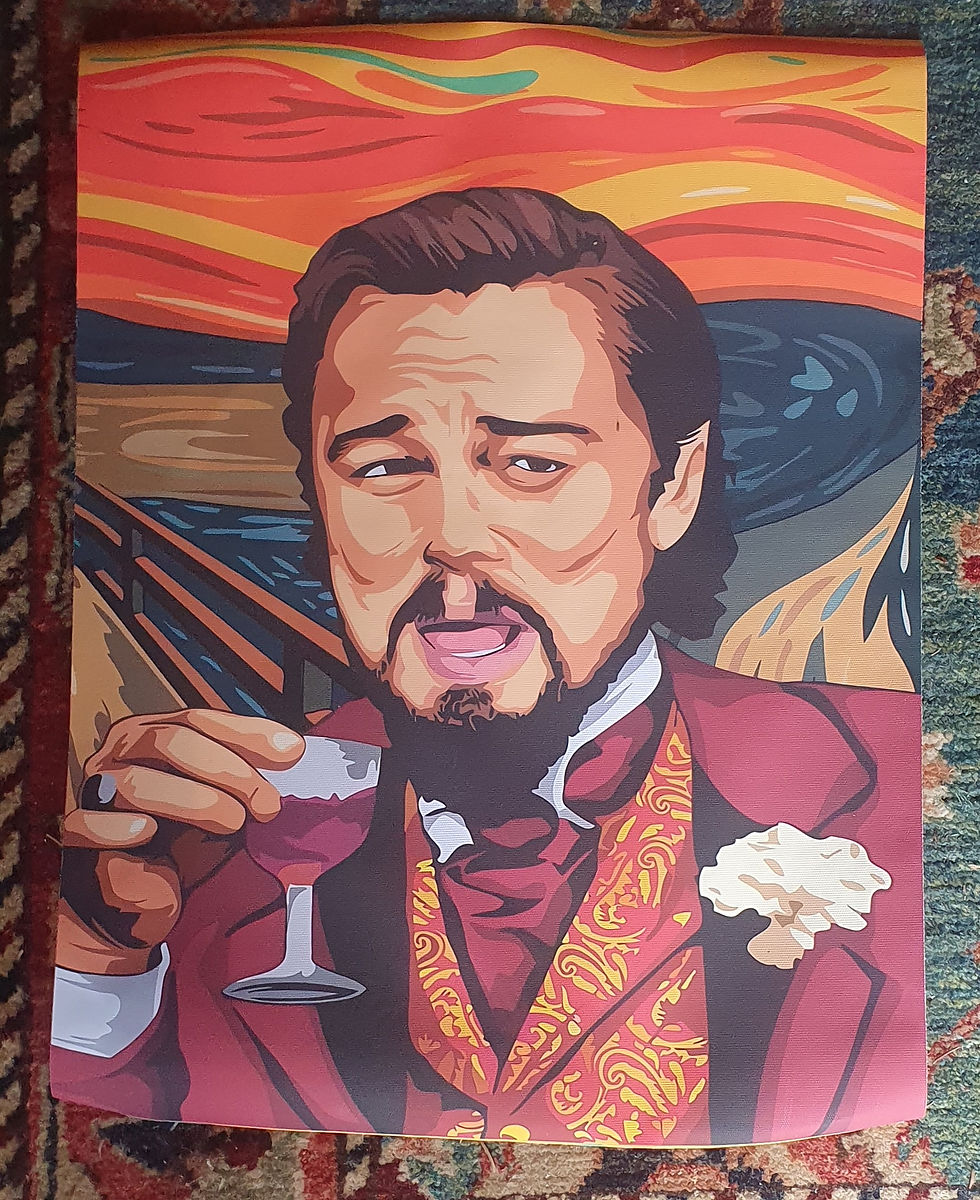

Reuters is reporting that Germany supports an overhaul of European Union import taxes which could end a duty exemption for cheap parcels that has helped online retailers such as Shein and Temu. This is welcome news because it at least begins to deal with the unfairness and imbalance in the marketplace caused by giving overseas retailers advantages that are unobtainable in the EU/UK. In the UK however such a move would cause problems for HMRC given that in January 2021 border based assessments of VAT were ended for items with a value below £135 and liability for paying the VAT was switched to the Seller (rather than the Importer/Consignee). This was done on the rather foolish assumption that non-UK sellers would either register for VAT or sell on a platform that collects VAT or even sell online (yes 'old fashioned' mail order still exists). Exactly how abuse of this gaping loophole will ever be policed has been addressed by HMRC as follows "HMRC will, as it does now, carry out extensive risk-based compliance activity away from the border using various data sources to identify and tackle non-compliance." This is nothing more than word salad. There is no way at all that HMRC can pursue the sender of a parcel in China for VAT, even if they knew about it (which they won't because nothing is checked at the border). Zero. Nada. Exactly how HMRC would collect duty when there is no assessment for VAT is anyone's guess but this cheap canvas I recently purchased from TEMU nicely sums up the view of the current parcels customs regime from outside the UK.

Comments